Oil Prices: Tracking Commercial Inventory Trends Rather Than SPR Trends

- bkkelly6

- Sep 18, 2022

- 8 min read

Author: Brynne Kelly 9/18/ 2022

Special Note: US SPR inventory balances have come under scrutiny lately as historic, record draws are set to come to an end in November of this year. This has been headline-making, more-so with President Biden announcing his intention to purchase oil at $80. We will address that in the context of this analysis which attempts to handicap what exactly is driving prices currently versus what could be driving them in the near future. We refer you to last week's Crude Oil SPR Inventory Levels at Historical Lows: Does it Even Matter? for more details.

Summary

Given the news items, the data, and the potential risks handicapping what is currently driving price action now will be helpful in knowing what may drive it in the near future. There are three likely candidates driving oil markets currently and in the near future:

SPR total draws - which are expected to become builds

Commercial Inventory levels now - and going forward

Product Inventories now- and how weather related demand will affect them

Background: What Do We Actually Know

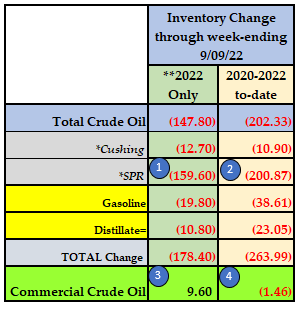

We know that since January 2020, total US crude oil inventory levels are down by 202.33 million barrels. Of that decline, 200.87 million can be attributed to the SPR (see #2 below). During that same time period however, US commercial crude oil inventories are largely unchanged, showing a mere 1.46 million barrel draw (#4 below). We use January 2020 as the start date as it coincides with the Pandemic when things went off the rails.

Commercial Crude Oil Inventories are largely unchanged from pandemic beginning due to SPR drawdowns...

Calendar-to-date changes for just 2022 are shown in the first data column of the table above, specifically #1 and #3 items for comparison. It paints the same picture: Massive draws from the SPR while commercial inventories remain stable.

Candidates One and Two: SPR and Commercial Inventories

The first two candidates are depicted below (black line vs green line). Nothing new, SPR inventories are on an epic decline while commercial inventories remain fairly flat. What is obvious is that the SPR is keeping the Commercial Inventories afloat. What's less obvious is that despite some anxiety that the SPR needs to be refilled, oil prices are lower now than they have been for months. SPR inventory has continued to decline along with futures prices.

This tells us that while SPR draws have put pressure on prices recently, the need for the SPR to be replenished is not front and center in the market's mind as expressed in price, at least not yet. The chatter is about the need to refill, but the price action is not focused on that yet. Given that prices are not currently concerned about what seems to be a mammoth refilling of SPR oil, what then are they focused on? Price action up until now seems to be more interested in the stability of the Commercial inventories, not the coming SPR refill.

Therefore, choosing between these two candidates (SPR and Commercial inventories) the market has cared less about the need to restock the SPR than many fear. Therefore, absent a material news item about the SPR, the markets activity should continue to be more dependent on the trajectory of commercial crude oil inventories. Independent of the SPR needing or not needing to be refilled, the slope of the Commercial inventories matters.

Weekly changes in US commercial crude oil inventory levels have been muted by draws from the SPR. We now need to see how they stand on their own merit, without the SPR crutch going forward.

Said another way, the SPR is today's news and will only become relevant when commercial inventories feel the pain. Rightly or wrongly, the market does not (yet) care about the need to refill the SPR. It is focused on the actual inventory. SPR inventory levels can rise and fall without notice in commercial levels. It only becomes a current problem when it is felt at the commercial level.

That said, if the market all of a sudden starts getting spooked about the SPR schedule, then we will see some pops in price. But until that happens: All eyes are on the 'green line' above.

Keep in mind that it was the build in commercial inventories that sent prices to record lows and a recession of commercial inventories that led to a recovery in prices.

Next up, we look at the SPR governance a little to get a better handle on what is going on with the "Biden $80 Bid" talk.

Some Context about SPR Purchase and Sales

SPR sales are governed by more 'blanket authority' than SPR purchases. The President can sell oil in an emergency pretty handily, but buying it is a lot more than just a public decree. it is a bureaucratic labyrinth.

SPR Sales:

"Section 161 of the Energy Policy and Conservation Act (EPCA) gives authority to the President under specified conditions to direct the Secretary of Energy to conduct a public sale of oil from the Strategic Petroleum Reserve."

SPR Purchases:

"The Energy Policy Act of 2005 directed the Secretary of Energy to develop procedures for the acquisition of petroleum products for the Strategic Petroleum Reserve (“SPR”). Pursuant to that direction, the Department of Energy (“DOE” or the “Department”) promulgated the Procedures for Acquisition of Petroleum for the Strategic Petroleum Reserve. Over the intervening 16 years, the existing regulations have become outdated due to changes in statutory authority, agency practice, and market dynamics. In this notice of proposed rulemaking (“NOPR”), DOE proposes to amend the procedures for the acquisition of petroleum products for the SPR to: more closely align the regulatory language with the applicable statutory language; remove outdated procedures for acquisition under the royalty-in-kind program; add procedures for acquisition by exchange to better reflect petroleum product acquisition operations as conducted by the Office of Petroleum Reserves; and increase the Department's flexibility in structuring acquisitions."

The comment period regarding this NOPR ended on September 6, 2022. No resolution has been posted regarding this yet.

Hopefully that puts some context around recent headlines suggesting that the Biden administration would 'purchase oil at $80 to refill the SPR'.

So why did the President mention SPR purchases last week? This is only speculation but it is quite possibly both political (telling voters he's not irresponsible) and geopolitical (giving OPEC a sign that the US wouldn't let oil fall more and would they pretty please not lower production anymore). Did he not also very recently say that we'd release more SPR oil if needed? Who knows why he is saying what is being said. Regardless he just can't spend taxpayer money trading oil when he likes to. At least not yet.

Putting that aside, the focus now should be on product inventories, where there HAS been a real decline.

Candidate Number Three: Product Inventories

Turning again to our table, we highlight not only the draw this year in product inventories (#5 & #7 below), but also the draw since January 2020 (#6 & #8 below).

What do you mean we don't have a Products SPR...

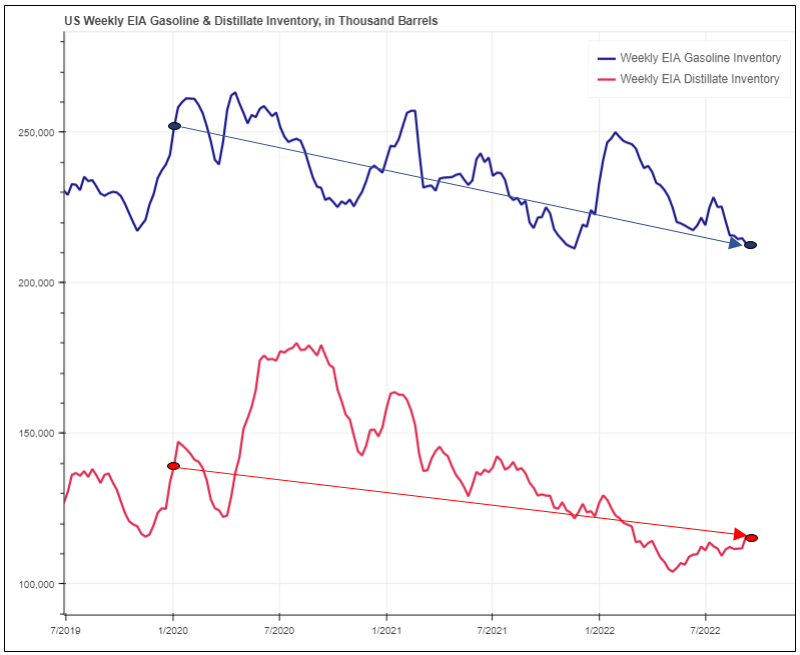

That's more significant than the change in Oil inventories. Here they are in context of historical inventory balances.

Gasoline is close to three year lows, heating oil Is a little better

This is the money shot along with commercial inventory levels. If the SPR continues to be ignored- these 'dials' need to move higher if oil/product markets want to move lower. The market awaits evidence going forward. For the moment, the Product markets are also not having a pronounced effect on Oil prices. Lets see how they are doing in their own world.

Crack Spreads

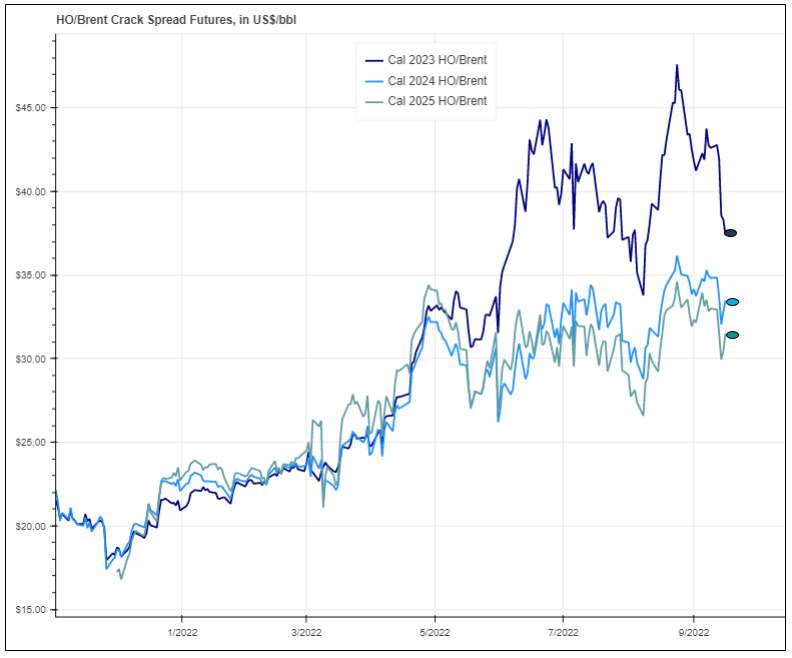

The issue with crack spreads lies in whether or not you believe there will be more furious buying in crude oil as a result of SPR inventory levels than there will be in refined products due to real spot demand this winter. As noted above, however, ground zero for now lies in commercial inventories of oil and refined products.

On a calendar strip basis, distillate cracks in the US (New York Harbor vs Brent) are on the rise, even though they have pulled back from recent levels.

US NYH Distillate vs Brent

New York Harbor gasoline cracks versus Brent are back to levels seen at the beginning of the year, while gasoline inventories remain below their 5-year average (see EIA inventory section at the end of this report).

US NYH Gasoline vs Brent

If our green line for Commercial inventories turns lower post SPR, and Products do not recover somewhat, then maybe a cold weather headline will have a pronounced effect.

But, if you are bullish right now, be bullish because of commercial inventory levels, weather forecasts, or crack strength. Be pleasantly surprised if the SPR narrative starts to move prices, but until it does, take the headlines with a grain of salt. It's a smart bet that if we get a cold snap the SPR refill narrative will be fuel on the fire then. It is also equally likely they will trot out the draw narrative in a cold snap to counter balance it as well too!

Calendar Spreads

One-month calendar spreads in crude oil have been on the decline. This is a reflection of commercial inventory levels stabilizing, largely attributed to SPR inventories declining and war premium normalizing.

Calendar Spreads now corroborate the Commercial Inventory Story...

We don't see the dial moving on these spreads until commercial inventories move one way or the other.

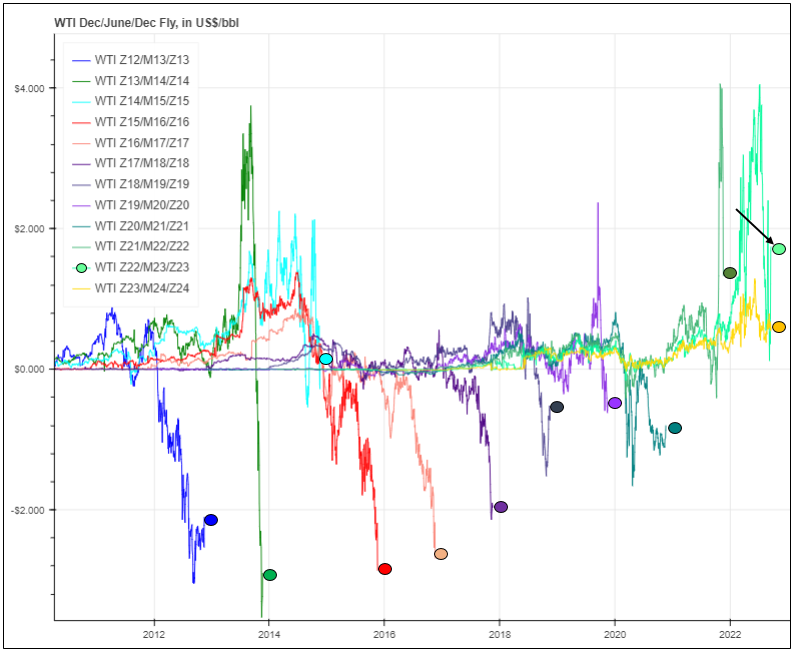

Seasonally however, there is still a premium in winter oil spreads relative to summer, as can be see via the Dec-22/June-23/Dec-23 butterfly. This spread captures the premium/discount of winter versus summer.

Seasonal Spreads corroborate the Products risk, specifically Heat for the moment...

The butterfly is trading higher than normal (lime green line above) which indicates there IS a winter premium built in to the market. Therefore, even though outright prices have moved lower, there is still structurally a winter bias. Perhaps this is where we see the impact of low SPR levels. Meaning that lower prices aren't erasing winter 'fears'.

Location Spreads

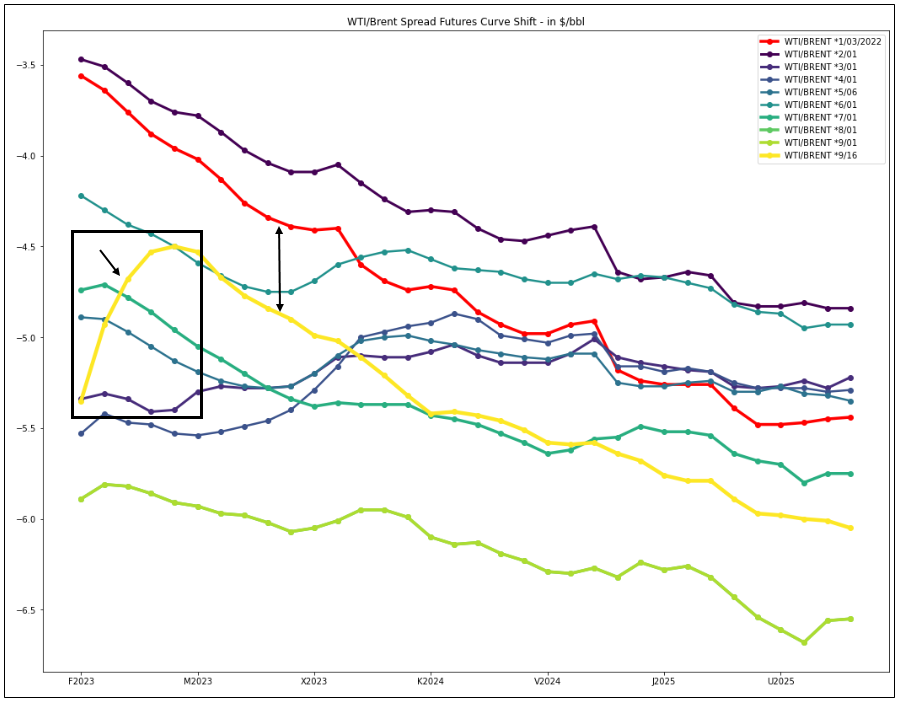

With the 'problem' of supply squarely targeted at the immediate winter season in Europe, an odd shape has taken hold in the spread between WTI and Brent futures.

Brent /WTI is Seasonally Reflecting Europe's Risk...

The shape of the curve in Q1 2023 (aka, winter) has taken on a geographical bias: Winter will have more impact on Europe than it will on the US (yellow line below). Hence the notable discount in WTI futures relative to Brent in the curve.

Note how this spread lays bear the fact that replacing US SPR inventories are not the issue in locational spreads.

Bottom Line

Of our three price driving candidates (as we exit hurricane season and enter winter):

SPR total draws

Commercial Inventory levels

Product Inventories

SPR is now the media focus as the next thing. And it may indeed be the next thing. But it is not the current focus of the market. If there were fears of an SPR buy back, flat price would likely not have come down so much and calendar spreads would certainly have stayed sticky as they did the when flat price cracked the first time about a month ago.

The current thing, and therefore the immediate next thing is the commercial inventory stability crushing upside volatility. Next we see the Products inventories not being as stable and therefore at risk of weather news. Finally, we see the cracks as being the sticky spreads now which confirms the low inventories and weather related anxiety. The bonus is the Brent/ WTI which indicates a need for EU oil, not US at present.

Absent material SPR news we view the stable commercial inventories as having the most influence on price, but the Products (not just heat) are where the anxiety lays right now. The green line and the weather (hurricane season) have been the focus for a couple of weeks. Absent weather or real SPR news, we will watch the green line, the cracks ,and how Brent/ WTI narrows if it does.

__________________________________________________________________________________

EIA Inventory Recap - Week Ending 9/09/2022

Weekly Changes

The EIA reported a total petroleum inventory DRAW of 3.60 for the week ending September 9, 2022. Commercial inventories however, posted a weekly BUILD of 2.40 while SPR inventories DREW by (8.40).

YTD Changes

YTD total petroleum EIA inventory changes show a DRAW of 178.40 through the week ending September 9, 2022. The bulk of this is due to drawdowns in SPR inventories.

Inventory Levels

Gasoline and Distillate inventory levels are now both below their 5-year average for this time of year.

Comments