Author: Brynne Kelly 8/07/2022

We are nearing the end of the 'Dog Days of Summer', which over the years has come to mean the hottest and most unbearable stretch of the season. Technically defined as the 40 days between July 3 and August 11 when the star Sirius, also known as the Dog Star for its prominence in the Canis Major constellation, rises in the morning sky.

The heat has been relentless this summer in the US and elsewhere. But, the end is in sight and, as a result, traders are looking ahead, trying to define the trajectory of current trends into the Winter season.

One narrative (with the potential to make a trend) that has taken hold over the last two weeks, is the concern about demand destruction and whether or not the US is in a recession. Never fear, though because a New York Times opinion piece over the weekend answered definitively about whether or not the US has entered a 'recession', despite recent GDP data pointing to such. The analogy-filled New York Times OPED piece was written by Kyla Scanlon, newsletter and YouTube video maker. The OPEDs main point was:

"There is no recession yet. Right now we are in a "Vibe-cession" of sorts - a period of declining expectations that people are feeling based on both real-world worries and past experiences. Things are off. And if they don't improve, we will have to worry about more than just bad vibes"

The article also states that "The vibes in the economy are....weird. That weirdness has real effects."

This is some real 'dog days of summer' talk, following what has been one of the most volatile periods in the economy over the last 2 years. Traders may have gotten used to wild headline risk upon which they can develop a strategy. But the dog-days may have also brought recessionary demand destruction pressure with them.

Reality Check

Perception in the oil complex has been that high prices are causing demand destruction and that this will be exacerbated by a recession. This has shifted the focus away from the supply side narrative (that has dominated this year) and markets have come under pressure.

It's fairly normal for existing narratives to come under pressure as we move from one season to another. This is happening right now. The end of summer is at least in sight. "Winter is Coming" memes may already be circulating amongst us but fears of winter 'shortages' are still a theory yet to be born out.

While we wait out this transition, let's review a few key fundamental data points in the oil complex for some clues going forward.

Crude Oil Inventory

Trends in inventory growth or contraction typically reveal themselves in the curve structure of oil markets. This has been fairly consistent at a macro level. For example, total crude inventory (commercial plus SPR, black line below) vs the continuous 1-month calendar spread (yellow line below).

Prompt spreads now drop even as EIA inventories (plus SPR) remain subdued....

What you might notice is that the recent decrease in backwardation doesn't seem to square-up with the severe decline in inventory levels.

There must be a reason. Toward that end, we present the next chart that excludes SPR inventory, leaving just Commercial inventory levels (red line below) as a comparison against the same 1-month calendar spread noted above.

Commercial inventories may have turned a corner, confirming the selloff...

In this comparison, the selloff in calendar spreads is at least palatable. US commercial inventory levels have been trending ever-so-slightly higher since the beginning of 2022 and this has stunted backwardation.

Should we not care about the depletion of US Strategic Reserves anymore? Has the market come to terms with the fact that SPR draws are coming to an end? Are we preparing to normalize at lower overall crude oil levels?

These are fair questions to consider, yet we pose one more: Aside from the SPR loans that must be repaid, is there any appetite for outright buying of oil to restore SPR inventory to their pre-pandemic levels?

For now, it seems like the market is discounting the impact that future purchases will have on prices. It's not an off-the-wall conclusion since the last thing the current administration wants to be seen doing is purchasing oil (gasp, a fossil fuel no less) and driving prices higher.

Positioning

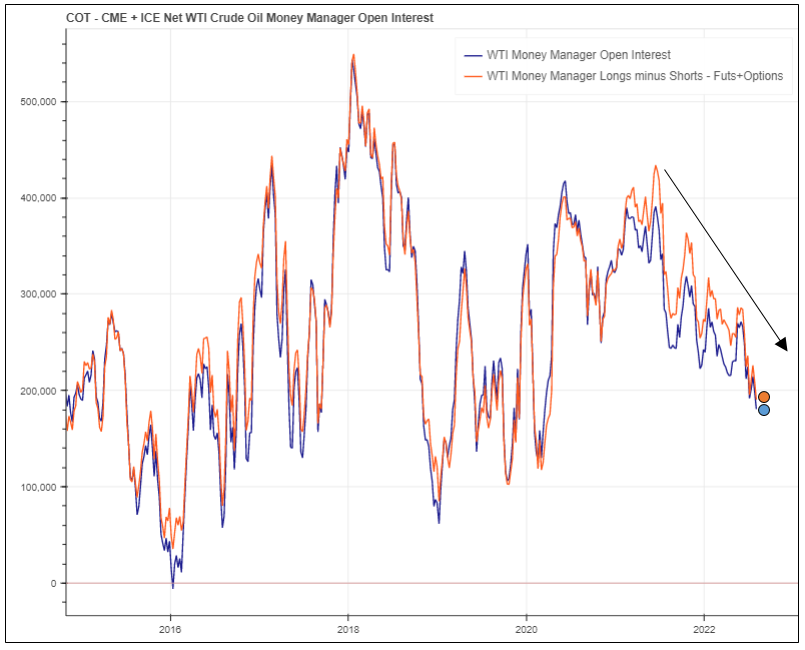

Open interest is waning, and has been doing so since the war started. Managed money open interest data bears this out. Reduction in overall length has coincided with SPR inventory hitting the market. But, there two additional macroeconomic factors working against money managers staying long oil:

The cost of money is up, courtesy the Fed

There remains less good collateral for structured deals

Open interest continues to decline in the sell-off...

Money flow is exiting the market for now, even though the fundamental data hasn't materially changed. Currently, fundamentals are taking a back seat to money flows. Some traders may have closed risk and are keeping their powder dry for now. It almost feels (dare we say "vibes"?) like an EOY environment which is even more exacerbated by the prior four months of chaos we witnessed.

Once August is behind us, focus on Fall supplies and weather risk will reemerge. Meaning that supply-side concerns may reassert itself come September. It is also worth noting that open interest reductions are easier to pull-off during a seasonal transitions as the new season's fundamentals have yet to be born out.

Gasoline Inventory vs Supply

The US gasoline market has a recognizable peak to trough season. Meaning we build inventory during the fall and winter, for use during the summer.

The peak-to-trough seasonality for RBOB has made significantly lower highs this year...

We also observed a peak-to-trough patter this year, however the peak inventory level reached ahead of the 2022 summer driving season was lower than the peaks seen over the last 6 years. At the same time, we have not seen 'trough lows' at the extremes we have seen in prior year. YET.

THIS is a trend that is still in it's infancy, but seems to be causing the market so much consternation. No one seems quite ready to abandon the rebound recovery in gasoline demand just yet. We are definitely watching to see if we make further lows in inventory levels from here.

Gasoline Demand

We all know that weekly EIA data for 'gasoline supplied by refiners' is used as a proxy for gasoline demand. Like it or not, it's the best data point out there. This is featured in the chart below.

The week-on-week variations in this data creates a lot of noise. What's of note in the chart above is that last week, gasoline demand implied by this data appears to be on the weaker side. Is this a price-driven crack in demand or a weekly disparity between the timing of import and export reporting? Once again, we see the beginning of a trend, but not an actual trend. Why? Because despite the shrinking demand noted above, this implied weakness is not yet making a positive impact on supply inventory levels.

Like it or not, differences in seasonal specifications for finished motor gasoline along with it's shorter storage shelf-life relative to crude oil, weekly gasoline supplied is more closely associated with end-user demand than unrefined crude oil is.

Bottom line, neither gasoline inventory levels nor gasoline demand are significantly 'out of bounds' YET. We need further data points going forward to prove this out one way or the other. Positioning ahead of this we leave to the demand forecasters.

Seasonal Spreads

As summer's end is in sight and winter is still an unknown, we look at seasonal spreads in both gasoline and distillate past and present. Specifically, the Oct versus Jan spreads (aka 'summer' versus 'winter').

Gasoline Oct vs Jan

Both spreads in gasoline and distillate have recently pulled back significantly from their recent spike highs.

Distillate Oct vs Jan

The message being delivered in both of these spreads is weakness in the front of the market relative to the back. Both are seeming to confirm that summer supply fears are winding down.

Gasoline versus Distillate

The relationship between gasoline and distillate isn't revealing much other than to confirm that distillate markets are tighter than gasoline markets as seen by the discount of gasoline to distillate markets this year.

Should this relationship break down on distillate weakness, that could put additional pressure on the overall complex. As it stands, the market still has faith in the winter shortage narrative and is pricing distillate accordingly.

Bottom Line

There is one last thing contributing to the mellowness this past week we failed to mention. We noticed post Biden's OPEC meeting, that the news-flow on oil died down a bit.

Thankfully, the political noise seems to have abated for now. War headlines, price-cap threats, and other rhetoric have taken a back seat to Taiwan/China and the dogged heat many are experiencing.

This, in combination with the reduced flows have put supply worries for this winter in limbo right now. Those worries may reassert themselves as soon as this fall. We still have the EU energy crisis on-going, hurricane season coming up, and US winter next after that. Plenty to worry about in September right? Enjoy the supposed calm before the storm.

__________________________________________________________________________________

EIA Inventory Recap - Week Ending 7/29/2022

Weekly Changes

The EIA reported a total petroleum inventory DRAW of (2.40) for the week ending July 29, 2022. Commercial inventories however, posted a BUILD of 4.40.

YTD Changes

YTD total petroleum EIA inventory changes show a DRAW of 140.10 through the week ending July 29, 2022.

Inventory Levels

Commercial Inventory levels of Crude Oil (ex-SPR) compared to prior years are have gone from way above historical levels to surprisingly below historical levels and should continue to flounder while backwardation in the market persists. The only 'worrisome' figure is gasoline inventory levels. The tiniest hint of 'normalcy' has raised demand 'concerns' for some.

Having only just found this commentary, there's some really useful information here! In the positioning section, the second reason for waning OI "There remains less good collateral for structured deals" could you exand on this for someone without a background in this area. What constitutes 'good collateral' and why is there a continued lesser amount of it around? Are we looking at a fundamental change in this area or is this a cyclical thing that ebbs and flows?